Frequently Asked Questions

Online Banking

Q: What exactly is Online Banking?

A: When we say "Online Banking" we are referring specifically to the web-based banking portal that is accessed using the web browser on a computer or mobile device. This is not to be confused with the "Mobile Banking" which is our downloadable app for mobile devices.

Q: Why must I re-enroll in the new Online Banking site when I am already enrolled now?

A: Our upgraded Online Banking website will take advantage of all new technology, so it’s not connected to the prior online banking site. But don’t worry! We’re here to help you with any questions you may have.

Q: Are there any services or functions that require Online Banking?

A: Yes. You can only make certain account information changes from within Online Banking, such as changing your email address. Also, you cannot view monthly statements in the mobile app.. Lastly, enrollment in these four services can only be done from within Online Banking: Bill Pay, eStatements, account alerts, and Zelle®. Once you have enrolled in these services, you can use them from the mobile app. Online Banking will no longer be required for these services after enrollment. Or, you know you are always welcome to stop by and see us in person!

Q: Must I still call or visit the bank to enroll in Online Banking?

A: No. You can enroll in Online Banking straight from your web browser. At the Online Banking login, click "First Time User" and follow through the enrollment steps. Call or visit us if you need any help.

Mobile Banking

Q: Can I still use the old mobile app?

A: No. The old mobile banking app no longer works. Please delete it from your devices and only use the new Simply Mobile® app.

Q. Can I do all my banking from the new Mobile Banking app?

A. You will need to use Online Banking to enroll in Bill Pay, eStatements, and Zelle. Recurring transfers will need to be set up on Online Banking but instant transfers or future-dated one-time transfers can be set up on the Mobile Banking app. Monthly statements cannot be viewed in the mobile app at this time. Also, you will need to install the new Card Manager app to help you control your First Fed Delta issued debit and credit cards, if you wish to use these services.

Q: Can I re-enroll in the new mobile app without first enrolling in Online Banking?

A: Yes. You can enroll in the new mobile app on its own. You are not required to enroll in Online Banking first. However, we do believe you’d enjoy the new Online Banking experience.

Q: Is the user name case sensitive in the mobile app?

A: Yes. The user name is case sensitive in the new Simply Mobile® app. Be advised when enrolling to pay close attention to the way you type your user name. Once you successfully log on to the app the firs time, the app will remember your user name going forward. Make a note of your user name and password in a very secure place.

Q: Can I use my fingerprint to log in on the mobile app?

A: Yes, you may use your smart device's biometrics to log in - whether that is fingerprint or face. To enable this feature, you must first log in using your password. Once you are logged in, at the bottom-right of the mobile app you will see a More button. Go to the Touch ID menu and then turn this feature on. The app will use the fingerprints or face mapping you already have stored on your smart device. No need to set it up new! From now on, when you start the app it will accept your biometrics to log on. If you have any trouble using biometrics after this point, the issue is generally one with the smart device rather than the Mobile Banking app. Please restart your smart device and try again.

Bill Pay

We have set up a special phone number specifically for Bill Pay support: 1-833-448-0044

Q: What happened to my scheduled bill payments?

A: The old bill payment system was completely replaced. Any payments and payees you had in the old system will need to be re-entered into the new system. The final day of the old Bill Pay system was November 12th. Please pay close attention -

Any bill payments in the old system scheduled on or after November 13th WILL NOT be paid!

Only payments set up in the new Online Banking system will be paid. Enroll in the new Bill Pay and set up those bill payments right away!

Q. Will Bill Pay send my payment the same day?

A. The definition of "same day" varies depending on who is receiving the payment. One company might stop receiving payments at 4pm while another might accept payments through 6pm. If you create a payment and want that to go out same day, doing so before 2pm Eastern is usually safe. The new Bill Pay system is intelligent enough to try and auto-fill the date, so you will have a better idea if you've already missed the time window or not. We also have a rush delivery option (additional fee required).

Q. Can I enroll in Bill Pay from the Mobile Banking app?

A. No. To enroll in Bill Pay you must do so within our Online Banking site. From then on you will be able to use Bill Pay through the Simply Mobile® app.

Q. Bill Pay can search for my bills and help me set them up?

A. Yes! The all new Bill Pay system includes Bill Discovery, which pulls from a database of over 600 utilities and popular companies. Bill Discovery can help you find your payee and set up a payment. Not in the system? Not a problem! If Bill Pay cannot find your payee, you can still set up a payment manually. You will want to have a recent bill handy to help you set up your payment.

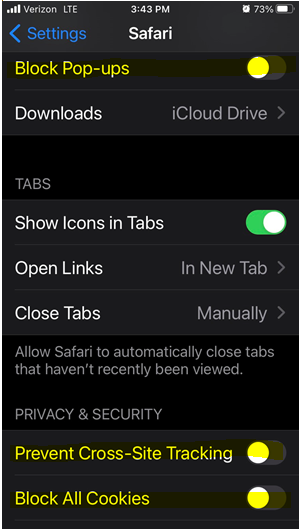

Q. Are there settings changes I need to use Bill Pay from Safari browser on an iOS device?

A. Yes. To use Bill Pay within Safari browser on an iOS phone or tablet you must turn off the “Block Pop-ups”, “Prevent Cross-Site Tracking” and “Block All Cookies” options. On your iOS device, open Settings, then scroll down until you see Safari. In the Safari options, make sure the sliders are in the OFF position for “Block Pop-ups”, “Prevent Cross-Site Tracking” and “Block All Cookies” options.

Q. Are there any fees or conditions for Bill Pay?

A. No fees. Available 24/7/365. Be aware of the limitations on same day payments and rush delivery.

Mobile Deposit

Please note that Mobile Deposit will become available on Wednesday, November 18th.

Q. What is Mobile Deposit?

A. Mobile Deposit is a new feature where you can use our new mobile banking app on your smart device to take a photo of the front and back of a check and use that photo to deposit that check into your account.

Q. Is depositing a photo of a check safe?

A. Yes! It is very safe, accurate, and fast. There is no security risk, since you are using our secure mobile app to make the deposit. Funds are usually available in your account within 6 minutes of deposit approval. Check images are kept and you will have access to those in your mobile app, usually within two hours. Any potential discrepancy can be identified, and we will be glad to help should you have any concerns.

Q. Can I use Mobile Deposit from the web browser on my smart device?

A. No. The Simply Mobile® app is required to use Mobile Deposit on a smart phone or tablet.

Q. Are there any fees or conditions for Mobile Deposit?

A. No fees. Our daily cutoff time is 4:00pm Eastern Standard Time, Monday through Friday. Checks deposited after 4:00pm Friday will not be reviewed until next business day (usually Monday but can be later depending on federal holidays). All deposits have a limit of $2,000 per check and $5,000 per day.

Zelle®

For more information on Zelle®, please refer to our Zelle® page.

Q. Must I enroll in Bill Pay in order to enroll in Zelle®?

A. Yes. You must enroll in Bill Pay in order to use Zelle®. Zelle® relies on the Bill Pay system in order to send money. This also means that you must register to use Online Banking, since you can only register for Bill Pay through Online Banking.

Q. I want to be able to use Zelle® but I am afraid I might overdraw my account.

A. You will not be able to overdraw your account when using Zelle®. If your account is often overdrawn, your use of Zelle® might be suspended which prevents overdraw.

Q. Are there any purchase protections using Zelle®?

A. No. Zelle® has no purchase protections. Zelle® is not a payment service. Be sure to use Zelle® only with people and entities you trust.

Q. I already use Zelle® through another bank, can I use it with First Fed Delta too?

A. Yes but it is important to know that Zelle® is associated with a particular financial institution. You can use Zelle® with more than one financial institution, but it will require registering from scratch with a unique phone number or email address. This means juggling two Zelle® accounts. The alternative is to transfer Zelle® from your current institution to First Fed Delta.

Q. Are there any fees or conditions for Zelle®?

A. No fees. Service is available 24/7/365. Transactions are in real time.

Card Manager

Please note that Card Manager will become available later on in December.

Q. Can I still use my Card Valet app?

A. No. Card Valet has become Card Manager. This is much more than a simple name change; the entire application has been improved. Card Manager is a separate app and not just a simple upgrade. When Card Manager becomes available, please delete the old Card Valet app from your devices and install Card Manager.

Q. Must I continue using the Card Manager app after I install it?

A. No. Card Manager app must be installed on your smart device to take advantage of its features, but once it is installed you have access to everything from within the Simply Mobile® mobile banking app. You no longer need to use Card Manager separately like you did Card Valet. Please do not delete Card Manager, but you do not need to actively use it.

eStatements

Q. Can I sign up for eStatements through my new mobile banking app?

A. No. To sign up for eStatements you must do so on our Online Banking site. You will then be able to view your statements through your mobile app.

Q. I receive eStatements currently, do I need to sign up for these again?

A. No. If you are currently receiving eStatements, you do not need to register again to receive eStatements.

Account Alerts

Q. Can I enroll in alerts from the Mobile Banking app?

A. No. To enroll in alerts you must do so within our Online Banking site. From then on you will be able to manage your alerts through the Simply Mobile® app.

Q. If I sign up for account alerts, how will those come to me?

A. The alerts come as text messages and/or email. You can also choose to receive badges on screen if you have the mobile banking app installed. To receive text messages, you will need a device that is able to receive text messages sent to a valid 10-digit phone number. (Messaging rates may apply, depending on your cellular service.)

Q. I have entered my personal information to enroll in alerts but is there another step?

A. Yes, there is another step. When you sign up for alerts in the Online Banking website, you will see that you may enter in an email address or a cell phone number (or both) to receive alerts. You must then Authenticate that email address or cell phone number. Press the Authenticate button, and the system will send you a message with a code inside. Enter that code into the Online Banking website. Now you are ready to receive alerts.

Q. Are account alerts real time?

A. Yes. With the new system in place, account alerts are now acting in real time. This is one of the improvements we are most excited to bring you. There will no longer be a lengthy delay between account activity and the issuing of alerts.

More

Q. These are a lot of changes. Is First Fed Delta still our local community bank?

A. Absolutely!! Without a doubt we are still your local community bank. We don't like to think of these as changes but improvements. We are not making these improvements so that we can leave our customers behind. We are making these improvements so we can simplify your life and make banking with us better in the 21st century than was possible before. We hope these improvements help you see that we are committed. First Fed Delta has been this community's bank since 1934. We have every intention of remaining this community's bank for many generations to come.

Q. Who do I call if I have problems or questions?

A. We will have “all hands on deck” the week of November 16th. Call or stop in to any branch and we'll be glad to help. If you have questions or issues specific to Bill Pay, please call our special Bill Pay hotline at 1-833-448-0044.

|